This process takes you through how to set up different tax types so they work with the Products / Services module.

- Click on the Administration link in the left-hand menu

- Find and click on the link Products / Services

- In the line Tax Types click on the option Add

- Tax Name: Enter the name of your tax type (e.g. GST, PST)

- Tax Rate: Enter the percentage of the total relevant for this tax (e.g. 10, 5). Use whole numbers only, do not use the percentage symbol (%)

- GL Code / Account: Assign what account the tax should be allocated to. This is an auto-find field - the GL Code / Account must be set up in Administration > Edit Drop Down Lists > Accounts before this step.

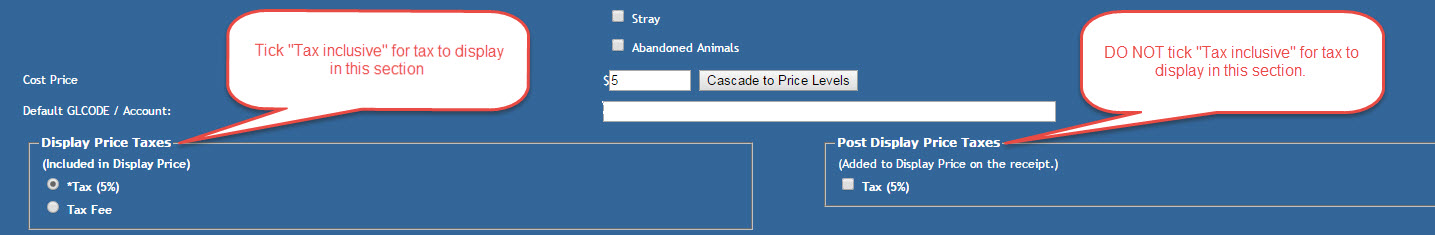

- Tax Inclusive:

- If the tax is to be included as part of the sale item's price, for example, GST, tick this box.

- If the tax is only to display post-sale and not as part of the item display price, for example, PST, DO NOT tick this box.

- Click Add Tax Type to finish.

You can edit the name or GL Code / Account assigned to a tax by clicking Tax Types - Edit option, but Tax Rates and whether or not is inclusive cannot be amended once created.

NOTE: Tax types cannot be deleted or deactivated.

Comments